The irs’ fresh start initiative is an umbrella term used to describe multiple tax relief programs that help taxpayers resolve their tax problems. According to irs.gov, “an offer in compromise (oic) is an agreement between a taxpayer and the internal revenue service that settles a taxpayer’s tax liabilities for less than the full amount owed.”.

Everything You Need To Know About The Irs Fresh Start Initiative 2019

The irs fresh start initiative was started to help these people get back on their feet.

Fresh start initiative irs reviews. Fresh start tax relief matches taxpayers who need help with tax resolution to a company that can meet their needs. Millions of americans have faced enormous financial hardships since the 2008 financial crisis. The irs began fresh start in 2011 to help struggling taxpayers.

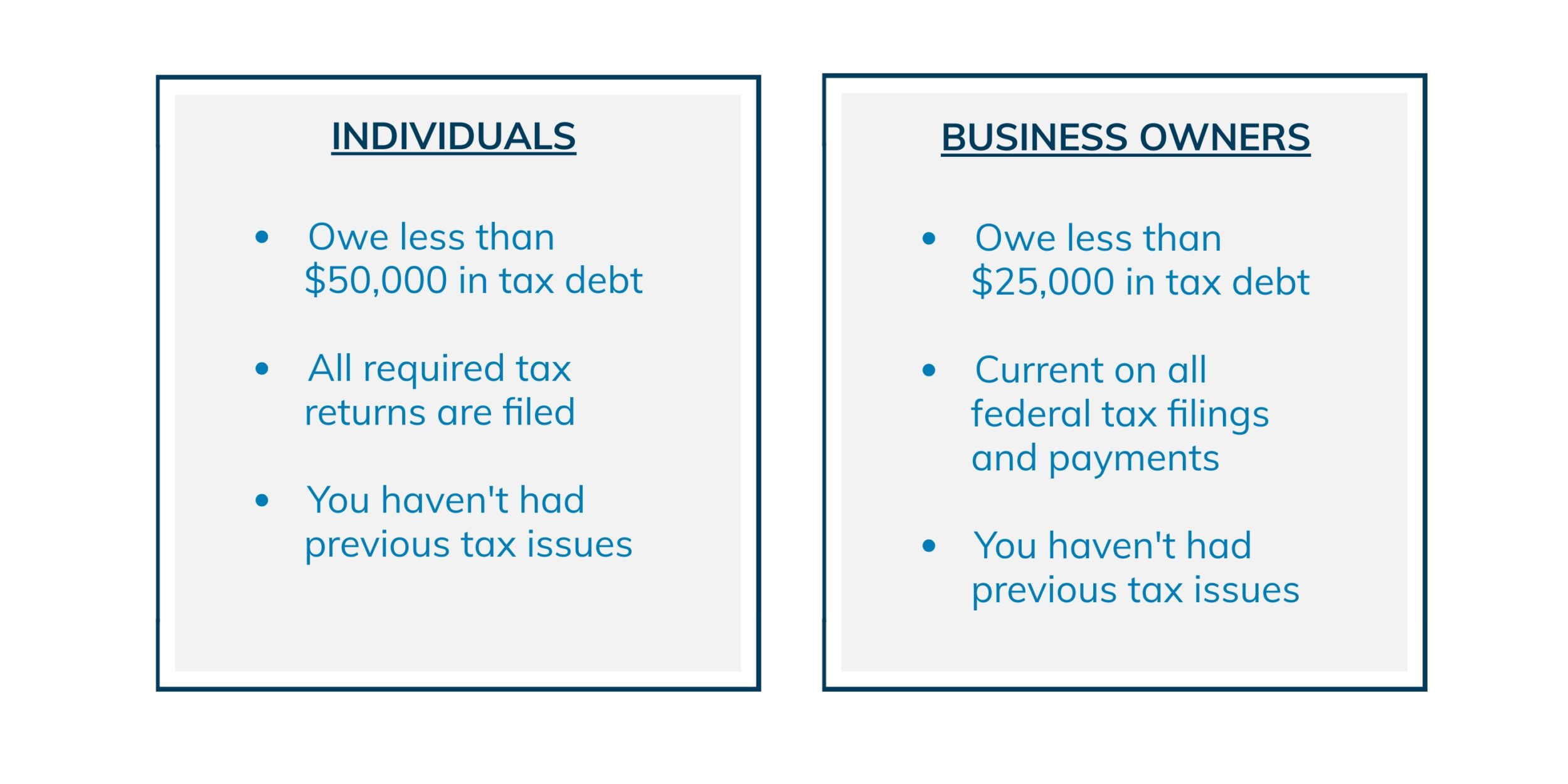

At the time, many taxpayers were struggling to address current and back tax payments without going bankrupt. Their team of enrolled agents and tax attorneys are pros at negotiating with the irs and are experienced with the irs fresh start initiative. There are three types of streamlined installment agreements:

They take all the paperwork off your hands. The fresh start initiative is a fantastic way of reasoning with the irs and asking for irs debt forgiveness or any other fresh start program. Americans with back taxes may qualify for tax relief in as little as 15 minutes.

You can fast track your application to the fresh start initiative by hiring a tax relief consultant like community tax. One of the programs to provide relief and moving forward is the irs fresh start initiative. The irs changed reasonable collection potential calculations from multiplying your.

The initiative is an extension of the irs restructuring and reform act of 1998. As long as you apply with good faith and qualify for the irs fresh start program, the chances of approval become higher if you also provide the irs with good reasons why you should be accepted. In some cases, the irs has forgiven 95% of back taxes owed.

Offering free consultation and obligation free services, fresh start initiative has been helping consumers decrease their tax debt since may 8th, 2017 by connecting applicants with verified cpas and tax attorneys. When a taxpayer is in this status, enforcement actions cease. The fresh start program expanded the oic program, creating more flexibility when assessing a.

The irs fresh start streamlined installment agreement allows you to quickly set up an installment agreement with the irs to repay back taxes over a fixed period with a fixed monthly payment, usually without providing financial information. If so, the irs fresh start program for individual taxpayers and small businesses can help. The irs calls these expenses “conditional” expenses, meaning taxpayers can have them allowed on the condition that they pay within 6 years.

In fact, the irs has implemented several programs around. Basically, this is how this irs fresh start program works: Notably, the irs fresh start is not a single program, but rather a series of changes that the irs has made to the tax code to alleviate tax bills.

Launched in 2011, the fresh start initiative (fsi) was designed to give delinquent taxpayers a “fresh start” on their taxes owed. The fresh start program made the process easier for individuals who owe $10,000 or less to qualify for a cnc by easing documentation requirements. In many cases, tax problems are best solved by irs enrolled agents, cpas, or tax attorneys.

For more information on the irs fresh start program,. “when someone has the irs breathing down their neck, the result is typically endless worry and sleepless nights. Important details regarding fresh start initiative.

Since that time, there have been several expansions to the program designed to help people facing problems like student loan and credit card debt. Over the years, the initiative progressed with incremental changes to irs collection procedures. It’s meant to help individuals in debt with the internal revenue service who cannot pay their way out.

Now, to help a greater number of taxpayers, the irs has The irs launched the fresh start initiative as a response to the 2008 recession. The fresh start initiative is often referred to as a program, when in reality it is a series of changes made to internal revenue service collection policies and procedures.

These programs include installment agreements, offers in compromise, tax lien withdrawals, and penalty abatement. Irs fresh start program assistance. The screening process for the fresh start program may be tedious but as long as you cooperate with the irs, the program would indeed help.

The average consumer may feel overwhelmed or confused by their tax issues and they may not fully understand. As an online aggregator, fresh start initiative is a particularly good choice for customers not entirely familiar with their tax relief options who want the flexibility to compare several different types of providers at once. Generally with the fresh start initiative, the taxpayer will need to provide sufficient documentation to justify this status with the irs.

The irs fresh start program offers real relief to taxpayers who owe thousands in back taxes. Fresh start initiative is a matching service that connects consumers with companies specializing in tax debt relief. The company does not offer tax debt resolutions itself.

Fresh start made it clear: Are you struggling to pay your federal taxes? The irs fresh start program can help you pay your taxes.

So helpful, i actually wonder how much longer it will last. Unfortunately, if you failed to pay your taxes on time and/or file the required paperwork. When you live abroad, it is easy to fall out of compliance with irs tax laws.

Therefore, it brings me great joy and satisfaction to get my clients content again, sleeping well, and boldly moving forward.”

Everything You Need To Know About The Irs Fresh Start Initiative 2019

Irs Fresh Start Program 2021 - What It Is And How To Qualify - Youtube

Does The Irs Offer One Time Forgiveness Tax Debt Advisors

What Is The Irs Fresh Start Program Fresh Start Initiative Explained Clean Slate Tax

Irs Hardship Currently Non Collectable Alg

Everything You Need To Know About The Irs Fresh Start Initiative 2019

Everything You Need To Know About The Irs Fresh Start Initiative 2019

Am I Eligible For The Irs Fresh Start Program - Tax Defense Network

Everything You Need To Know About The Irs Fresh Start Initiative 2019

Irs Fresh Start Initiative Program Help Dallas Fort Worth Tx - Myirsteam

What Is The Irs Fresh Start Program Fresh Start Initiative Explained Clean Slate Tax

Owe Money Get A Fresh Start With The Irs Fresh Start Initiative The Turbotax Blog

Irs Fresh Start Program How It Can Help W Your Tax Problems

U0g5u7humm6jum

Irs Fresh Start Program Makes It Easier To Settle Back Taxes - Debtcom

Optima Tax Relief Review 2021 Is It Legit Findercom

Reasons For Passport Denial Penalized For Delinquent Taxes Debt

Everything You Need To Know About The Irs Fresh Start Initiative 2019

Whats The Irs Fresh Start Program The New Initiative Guide Video